FREE U.S. SHIPPING OVER $50

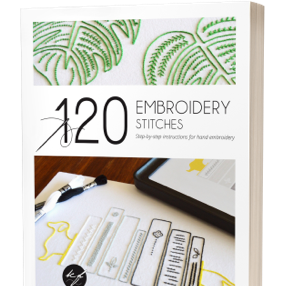

Shop Supplies

Looking for supplies with accessibility features? We have those.

Just getting started?

Learn how to start, stitch, and finish your first project with free tips from our library.

Visit the library

Maydel By the Numbers

We put our money where our mouth is.

100% carbon neutral

via carbon reductions and offsets

$15/hr minimum wage

pledge signatory

1% of revenue donated

to environmental justice projects